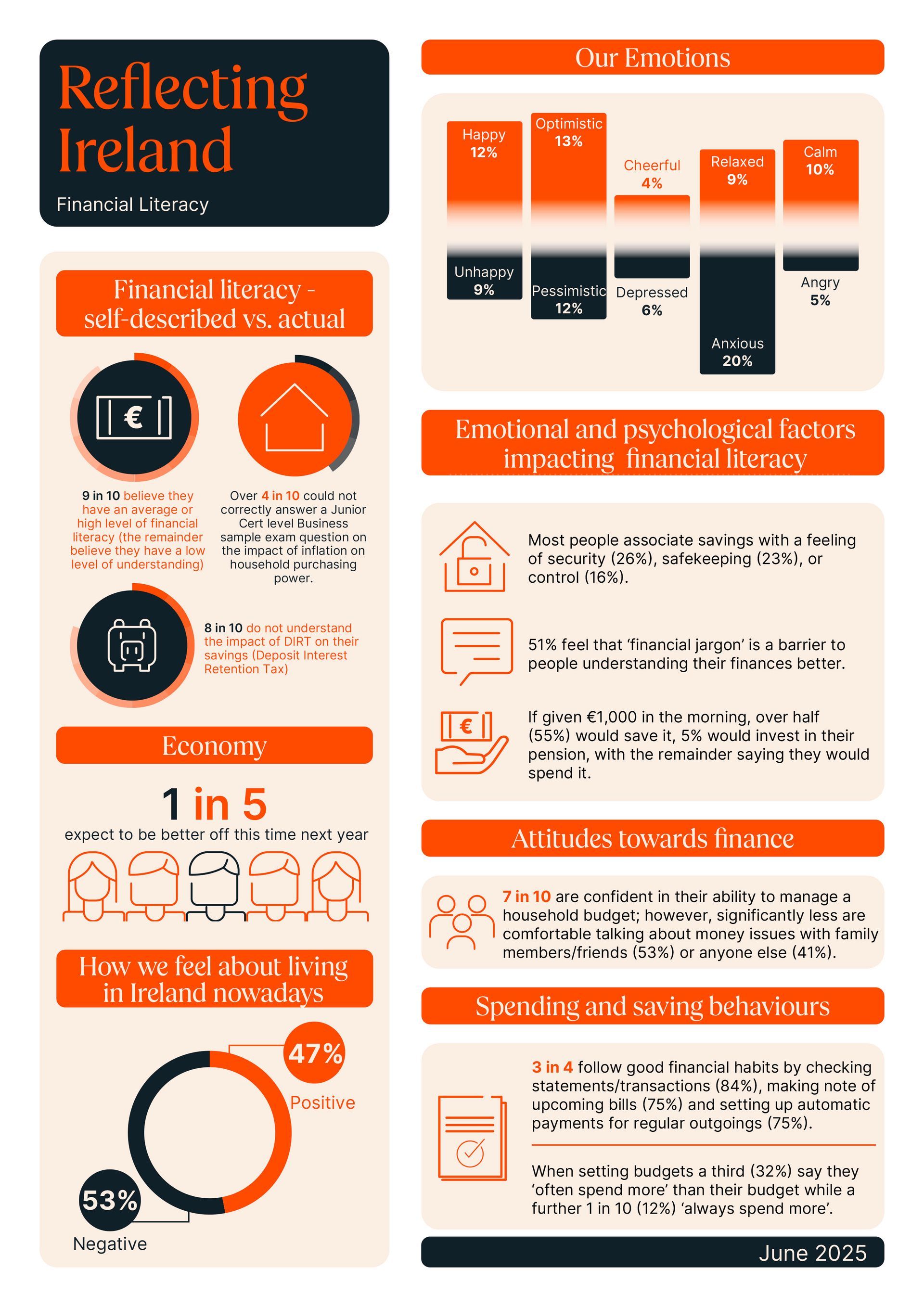

Reflecting Ireland - Financial Literacy

The latest issue of PTSB Reflecting Ireland research series published yesterday reveals a gap between the percentage of people that feel they have a good or average level of financial literacy, and those that actually do.

Perception-Reality Gap:

9 in 10 respondents rate themselves as having ‘average’ or ‘high’ financial literacy, however 4 in 10 fail to correctly answer a question on the impact of inflation on purchasing power, and 8 in 10 fail to calculate the impact of Deposit Interest Retention Tax (DIRT) on savings interest earned. Questions were taken from a sample Junior Cert level Business exam.

The benefits of good financial literacy:

Financial literacy is an important contributor to financial wellbeing, a core element of overall wellbeing. It is defined by the OECD as a core life skill for the 21st century. Financial literacy helps people make informed decisions about how to manage their money including borrowing, saving, protecting and investing for the future. It supports financial resilience, helping people manage during financially tough times. Good financial literacy helps people feel better about their finances generally.

The toll of low financial literacy:

Those who describe themselves as having low financial literacy are more likely to feel down about their finances (65% vs. 22% among those reporting high financial literacy), to say that money worries keep them awake at night (55% vs. 35%), to feel uncomfortable talking about money issues to close friends or family members (47% vs. 17%) or to anyone else (59% vs. 23%) and to feel anxious about life generally (24% vs. 13%). They are also the least likely to budget, keep track of their spending or seek financial advice.

How Ireland compares:

A 2023 OECD report ranked Ireland 3rd among 39 countries on financial literacy, so relatively speaking Ireland performs well. However, the latest issue of Reflecting Ireland highlights that more work needs to be done to ensure Ireland adopts a more inclusive approach to financial literacy. In February of this year the Irish Government launched Ireland’s first National Financial Literacy Strategy. The 5 year plan covers 2025 to 2029 and aims to promote financial literacy across the whole of Irish society.